Corporate Governance

Since 2005, we have been listed on B3’s Novo Mercado segment, which reflects our public commitment to follow the best practices of governance, in addition to what is required by the Brazilian legislation and the Securities and Exchange Commission of Brazil (CVM). As per Novo Mercado regulations, Cosan issues common shares with voting rights.

After the corporate restructuring in 2021, we joined the Level 2 American Depositary Shares program on the New York Stock Exchange (NYSE), which bound Cosan to certain rules of the Securities and Exchange Commission (SEC). Click here for more information.

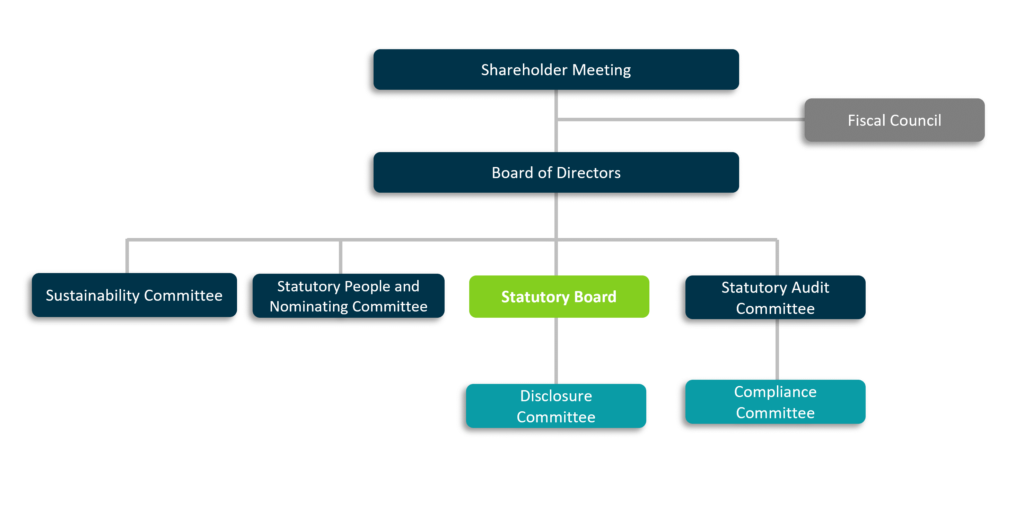

Cosan is managed by the Board of Directors and the Executive Officers. The Board of Directors members are elected at the Shareholders Meeting, while the Executive Officers are elected by the Board of Directors, both to serve a 2-year term of office.

Governance Structure

Novo Mercado

The Novo Mercado rules require the obligations imposed by the current Brazilian legislation and compliance with the following requirements, among others:

- Issue only common shares;

- Do not accumulate the positions of Chair of the Board of Directors and CEO;

- Establish in the bylaws that the Board of Directors must have at least 2 independent directors or 20% of them, whichever is greater;

- Disclose the charters of the board of directors, its advisory committees and the fiscal council; and

- Disclose in the reference form, in table format, by body, the value of the highest, the lowest and the average annual remuneration of the Board of Directors, Statutory Audit Committee and Fiscal Council related to the last fiscal year. See further information about remuneration in the Reference Form.

Evolution of our Governance

We strengthened our governance model in recent years by creating various non-statutory committees to support management, such as: (i) Sustainability Committee; (ii) Disclosure Committee; and (iii) Compliance Committee. The Company also has the Audit Committee and the People and Nominating Committee, which are statutory.

We have a solid risk management structure to identify events that could have a negative impact on the sustainability of our business. Our methodology includes assessments of the probability of occurrence and of the financial, environmental, social, commercial, market, legal/regulatory, health, security, image and reputation impacts.

We revisited the scope of the Audit Committee, increasing the focus on Information Security and Cybersecurity, with the role of reporting to the Board of Directors our evolution in the topic. We expanded the People Committee to People and Nominating Committee, aiming for sustainability and diversity in the Company’s talent pipeline, as well as increasing the independence and diversity of our Board. We have also created a Compliance Committee to consolidate the guidelines of Cosan’s Anticorruption Program and to concentrate all the reports involving ethical issues and violations of the Code of Conduct.

As regards Information Security and Cybersecurity, this is a priority issue at Cosan. With monthly reports of the team to Cosan’s CEO and CFO and periodic presentations to the Audit Committee and Board of Directors, this topic is part of the regular agenda of the Audit Committee, which has held at least five meetings with presentations, reports with security indicators and progress on projects related to the topic. See more information here.

In 2023, we signed the letter of commitment to the 100% Transparency Movement, an initiative of the UN Global Compact – Brazil Network that strives to engage companies in combating corruption to achieve the Sustainable Development Goals (SDGs) of the 2030 Agenda. See more information on ESG.

Corporate Governance Practices

We list below some corporate governance practices at Cosan:

- Current Board of Directors composed of: 5 non-independent members and 4 independent members, among them, 2 women;

- Executive Board composed of 3 members, among them, 1 woman;

- Sustainability Committee presided over by an independent woman director;

- Evolution in the ESG performance (see more information here);

- Statutory Audit Committee, 100% composed of independent members, and among its duties are risk management and the supervision and monitoring of information security and cybersecurity;

- Corporate policies, such as Clawback, Anticorruption, Human Rights, Anti-harassment and Anti-discrimination, Compensation, Sustainability, Risk Management, Negotiation and Disclosure, and CEO Succession.

For further information about the Board of Directors, Executive Board and Company’s Committees click here.

For information on the external auditor’s report and auditor’s remuneration, see Form 20-F.